Out of Network, Out of Luck: How Remote Work is Widening the Healthcare Gap Between Generations

Millennial and Gen Z workers are twice as likely to struggle with in-network access—leaving insurers with a growing retention problem to solve.

As remote work continues to redefine the workforce, employer-sponsored healthcare plans are struggling to keep up.

Traditional provider networks were designed around employees working near major metropolitan areas, where in-network providers are readily available. However, the shift toward a decentralized workforce has exposed critical gaps in coverage, particularly for younger employees who are more likely to work remotely. Without proactive adjustments, these gaps risk driving up out-of-network costs, reducing employee satisfaction, and contributing to higher turnover for businesses.

We know these gaps exist because we used the third-party survey platform Pollfish to ask 600 remote American workers who lived in states outside of where their companies are located about their experiences with their employer-provided healthcare and how well it met their needs.

What we found and what’s highlighted in this report is the growing disconnect between health networks and remote employees. Here, we dig deeper into how network rental could be a strategic solution to expand access, reduce out-of-network reliance, and enhance healthcare plans to better serve a geographically dispersed workforce. By addressing key coverage challenges—such as specialist and mental health access—and aligning healthcare offerings with workforce trends, insurers can strengthen employer partnerships, improve member satisfaction, and position themselves as leaders in a rapidly evolving healthcare landscape.

Younger Remote Workers Struggle with In-Network Access

A key finding from the data is that younger remote workers (ages 18–44) face disproportionate difficulties in accessing in-network healthcare providers. While 46% of all remote workers report relying on out-of-network providers to some extent, that number jumps to 59% among millennials and Gen Z employees. Additionally, 54% of this age group experience issues accessing in-network care either frequently or somewhat frequently—higher than the overall 46% of all respondents and significantly more than the 38% of respondents 45 and older.

This disparity suggests that the traditional employer-sponsored insurance model is misaligned with the realities of a decentralized workforce. Insurers relying on static network structures built for office-centric employees are leaving remote workers with gaps in coverage, leading to increased reliance on out-of-network providers, which ultimately translates to higher out-of-pocket costs for members and increased dissatisfaction.

How much do you rely on out-of-network providers due to your remote work location?

Respondents 18 to 44 years old.

The Business Impact: Retention Risks Due to Healthcare Frustration

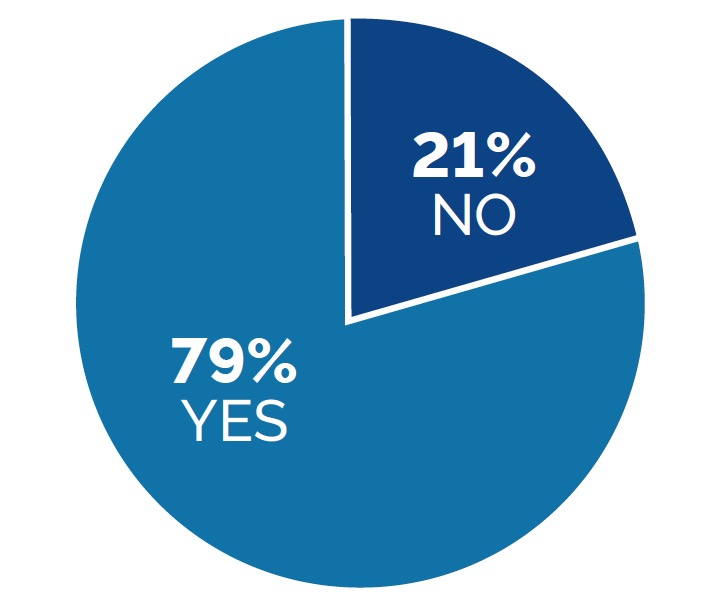

Perhaps the most alarming statistic for employers and insurers alike is the impact healthcare access has on workforce retention: 79% of younger remote employees have considered switching jobs due to healthcare coverage concerns, compared to only 57% of older workers. Within this younger demographic, 36% view healthcare as a major factor in job decisions, while another 44% weigh it as a contributing factor.

Have you ever considered switching jobs due to inadequate healthcare coverage for remote workers?

Respondents 18 to 44 years old

This trend poses a risk not only to individual employers but also to insurance providers. If a company’s health plan is perceived as inadequate for remote workers, employees may seek out roles with better healthcare options, driving talent attrition for the business and prompting employers to reconsider their insurance partners.

The Case for Network Rental as a Strategic Solution

For healthcare insurers, these findings present a strong case for network expansion through rental agreements, especially for plans serving remote or geographically dispersed employees. By partnering with established networks in areas where employer-sponsored plans have weak coverage, insurers can:

- Expand access to in-network providers, reducing out-of-network reliance for remote employees.

- Improve member satisfaction, lowering the likelihood of job-hopping due to healthcare concerns.

- Strengthen employer relationships, offering a competitive advantage for companies seeking to attract and retain top talent in remote work environments.

- Control costs, as improved network access minimizes out-of-network claims, lowering reimbursement expenses for insurers and reducing financial burdens on members.

Once again, the data underscores a pressing issue: employer-sponsored health plans are struggling to meet the needs of younger remote employees, and this dissatisfaction is directly impacting job retention. For insurers, this is both a challenge and an opportunity. Network rental offers a scalable solution to bridge these gaps, ensuring that remote workers—particularly those in younger demographics—receive adequate in-network care. As remote work continues to shape the labor market, insurers that proactively address these challenges through strategic network expansion will be better positioned to support their employer clients and retain valuable members in an evolving healthcare landscape.

Network Expansion Can Address Healthcare Gaps for Remote Workers

As healthcare insurers evaluate strategies for expanding coverage, survey data underscores a growing disconnect between traditional health networks and the evolving needs of remote workers. With 63% of respondents stating that healthcare is not adapting quickly enough to accommodate remote work, insurers have a clear opportunity to enhance their offerings through network rental agreements, particularly in underserved areas such as specialist care, mental health services, and primary care access.

Healthcare Networks Are Falling Behind

The survey data shows that while 36% of respondents believe health networks are keeping pace with the shift to remote work, the vast majority—63%—feel that healthcare is lagging behind or has room for improvement. Notably, 55% of respondents believe there is some attempt at adaptation but that more improvements are needed, while a not-insignificant 8% feel health networks are outright failing to meet the needs of remote workers.

Do you feel that health networks are adapting quickly enough to meet the needs of a remote workforce?

Yes, they are keeping up with the shift.

Somewhat, but there's room for improvement.

No, they are behind and need to improve.

This perception signals a gap in network accessibility that healthcare insurers must address to retain employer clients and their remote employees. If members frequently struggle to find in-network providers, it increases their out-of-pocket expenses, lowers satisfaction, and makes employer-sponsored plans less competitive in an increasingly flexible job market.

The Market Potential for Remote-Optimized Healthcare Plans

When asked if they would opt for a health plan specifically designed for remote workers, responses indicate a latent demand for better network coverage, though cost remains a concern.

22%

would prioritize better remote coverage even with higher premiums—suggesting that a segment of workers values access to care over cost savings.

34%

are open to a remote-optimized plan if the benefits outweigh the cost, indicating an opportunity for insurers to position expanded network access as a high-value differentiator.

18%

prefer lower-cost plans despite limitations, reinforcing the need for flexible plan structures that offer both affordability and broader coverage options.

These responses suggest that while not all remote employees would pay more for a specialized plan, but a large percentage (76%) would at least consider it if it meant better provider access. For insurers, this presents an opportunity to enhance employer-sponsored plans through network rental partnerships, allowing them to improve coverage for remote employees without requiring a fully customized or high-cost plan.

If given the choice, would you prefer a health plan designed specifically for remote workers, even if it meant higher premiums?

Respondents 18 to 44 years old

The Most Underserved Areas:

Addressing Gaps in Specialist and Mental Health Care

One of the most telling findings from the data is that specialist care (35%) ranks as the most underserved healthcare service for remote workers, followed by mental health services (31%) and primary care providers (29%). These trends were consistent across all respondents, reinforcing the notion that gaps in targeted, specialized care are a systemic issue within existing health networks.

For insurers, expanding specialist and mental health networks through rental agreements presents a strategic opportunity to:

- Improve accessibility for remote workers who currently struggle to find in-network providers.

- Enhance plan value for employer clients, making coverage more attractive for their increasingly remote workforce.

- Address growing demand for mental health services, a critical component of employee well-being and productivity.

Additionally, preventative care (23%) and prescription drug access (20%) were noted as underserved, signaling that a more comprehensive approach to network rental could address multiple points of friction in remote healthcare access.

Conclusion

The data paints a clear picture: traditional health networks are not evolving quickly enough to meet the needs of remote workers, leading to dissatisfaction, coverage gaps, and increased interest in alternative solutions. As more companies embrace flexible and decentralized work models, health insurers that expand their networks—particularly in specialist and mental health services—will be better positioned to retain employer partnerships and improve member experience. Network rental is a cost-effective and scalable way to bridge these gaps, allowing insurers to offer broader in-network access without the need for complex plan overhauls.